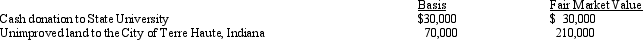

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2013:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

Definitions:

Spinothalamic Pathway

A sensory pathway of the spinal cord that transmits pain and temperature sensations to the brain.

Decussation

The crossing over of nerve fibers or pathways from one side of the brain or spinal cord to the other, allowing for the exchange of information.

Fasciculus Gracilis Tract

A sensory pathway in the spinal cord responsible for transmitting touch and proprioception information from the lower body.

Anterior Spinocerebellar Pathway

A neural pathway that carries sensory information from the spinal cord to the cerebellum, important for the coordination of movement.

Q1: In the purchase of a partnership,does the

Q3: A participant has an adjusted basis of

Q13: A taxpayer who uses the automatic mileage

Q66: Section 482 is used by the Treasury

Q72: Sage,Inc.,has the following gross receipts and

Q80: An effective way for all C corporations

Q92: Do the § 465 at-risk rules apply

Q104: James,a cash basis taxpayer,received the following compensation

Q124: If a business entity has a majority

Q147: During 2013,Esther had the following transactions: <img