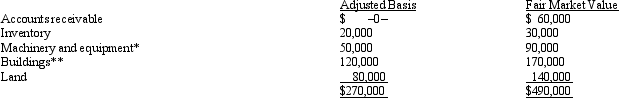

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Catecholamines

Organic compounds, including neurotransmitters like dopamine, norepinephrine, and epinephrine, that play significant roles in the body's response to stress or fear.

Newborns

Infants from birth to one month old, a period characterized by rapid physiological changes and dependency on caregivers for survival.

Breathing Problems

Conditions that impair the body's ability to take in oxygen and expel carbon dioxide, affecting respiratory function.

Lamaze Technique

A childbirth preparation method that emphasizes natural childbirth and techniques to cope with labor pain through breathing, relaxation, and concentration.

Q7: In terms of IRS attitude,what do the

Q13: What method is used to allocate S

Q17: Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates

Q19: Which publisher offers the Standard Federal Tax

Q31: Ralph owns all the stock of Silver,Inc.,a

Q48: Which statement is not true with respect

Q75: Explain the purpose of the tax credit

Q84: Sick of her 65 mile daily commute,Edna

Q105: Duck,Inc.,is a C corporation that is not

Q106: Susan is a self-employed accountant with a