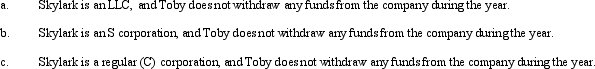

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Definitions:

Giver

An individual who provides or transfers something to another without expecting anything in return, often enhancing social bonds or contributing to communal welfare.

Altruistic Behaviour

Actions taken to benefit others without expecting any benefit or reward in return.

Prosocial Behaviour

Acts that are positively valued by society.

Payoff

The return or result obtained from an investment or action, often used in the context of games, economics, and decision-making.

Q6: Molly is a 30% partner in the

Q11: Who was the first psychoanalyst to describe

Q11: An S corporation with substantial AEP records

Q11: What perspective says that rape is the

Q16: The Oedipus complex is linked to<br>A) a

Q19: Genes are<br>A) the chemical building blocks of

Q39: Which of these is NOT part of

Q63: Property can be transferred within the family

Q68: For a new corporation,a premature S election

Q86: Social considerations can be used to justify:<br>A)Allowance