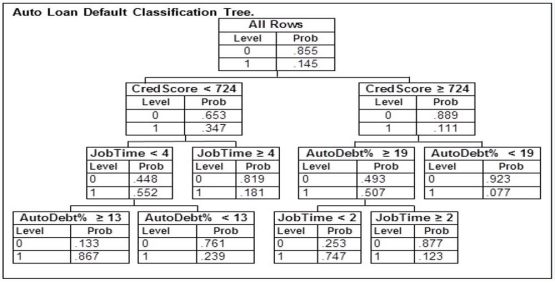

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 600 who has just started their current job with a monthly salary of $5,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

A potential borrower with a credit score of 600 who has just started their current job with a monthly salary of $5,000 would like to apply for a loan. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following monthly payments, which is the highest this loan could have to be approved for this potential borrower?

Definitions:

Anti-anxiety Medication

Drugs prescribed to reduce or control feelings of anxiety and its physiological effects.

Stop Smoking

The process of ceasing the habit of inhaling and exhaling the smoke of tobacco products, typically to improve health.

Hurricane Katrina

A devastating Category 5 hurricane that struck the Gulf Coast of the United States in August 2005, causing widespread destruction and loss of life.

Gulf Of Mexico

A large oceanic basin located in the southeastern United States, bounded by North America, Mexico, and Cuba, known for its significant biodiversity and oil resources.

Q18: Consider a Poisson distribution with an average

Q29: A cable television company has randomly selected

Q65: An internet service provider (ISP) has randomly

Q73: Sampling error occurs because a characteristic of

Q79: A cable television company has randomly selected

Q90: When sample size is 16, find t<sub>.025</sub>.

Q99: Find z when the area between z

Q100: The following is a relative frequency distribution

Q118: In a statistics class, 10 scores were

Q140: Interpret a lift ratio of 1.111.