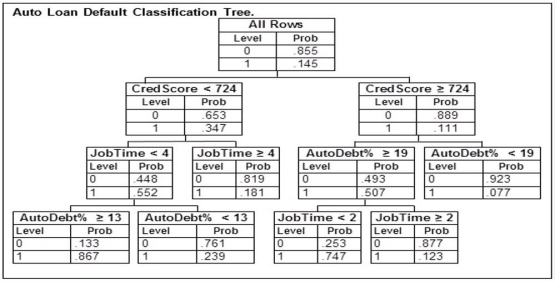

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  Based on this classification tree, a member of the study sample who had a credit score of 774, just started their current job, took out a loan with payments equaling 19% of their income, and did not default would be

Based on this classification tree, a member of the study sample who had a credit score of 774, just started their current job, took out a loan with payments equaling 19% of their income, and did not default would be

Definitions:

Silent Generation

The demographic cohort following the Greatest Generation, typically defined as people born from the mid-1920s to the early 1940s, known for their hard work and quiet contribution to society.

Organizational Productivity

A measure of how efficiently and effectively a company or organization can produce desired outputs using the inputs available.

Prejudice

A preconceived opinion that is not based on reason or actual experience, often leading to biased judgments or discriminatory behavior.

Discrimination

refers to unjust or prejudicial treatment of different categories of people, especially on the grounds of race, age, sex, or disability.

Q3: An MBA admissions officer wishes to predict

Q8: For a binomial process, the probability of

Q12: A cable television company has randomly selected

Q25: Recently an advertising company called 200 people

Q37: An auditing firm has developed a set

Q68: The following table shows the Price-to-Earnings ratio

Q79: A cable television company has randomly selected

Q102: For any sampled population, the population of

Q115: If x is a binomial random variable

Q144: Which of the following is influenced the