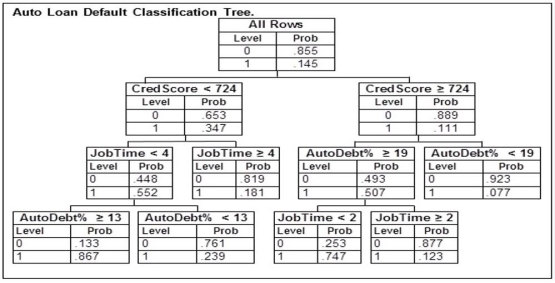

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 752 who just started their current job is applying for a loan with payments equaling 19% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

A potential borrower with a credit score of 752 who just started their current job is applying for a loan with payments equaling 19% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be

Definitions:

Macroeconomic Equilibrium

A state where aggregate supply equals aggregate demand, resulting in a stable economy without tendencies to change.

Great Depression

A severe worldwide economic downturn that lasted from 1929 until the late 1930s, characterized by massive unemployment and deflation.

Government Policy

The deliberate action or inaction by a government or public authority to address public issues and promote welfare.

Aggregate Demand

The aggregate need for products and services in an economy at a specific price level during a certain time frame.

Q4: X has the following probability distribution. <img

Q6: Joe is considering pursuing an MBA degree.

Q19: If the sampled population is exactly normally

Q26: If events A and B are mutually

Q32: Suppose that a company's annual sales were

Q33: Employees of a local university have been

Q65: An auditing firm has developed a set

Q83: An automobile finance company analyzed a sample

Q106: The following is a partial relative frequency

Q143: For a continuous random variable x, the