Use the information for the question(s) below.

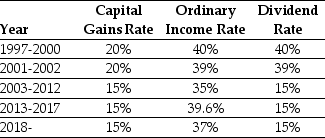

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a pension fund in 2006 was closest to:

Definitions:

Offensive Behavior

Refers to actions or remarks that are hurtful, inappropriate, or cause discomfort to others.

Manipulating

Influencing or controlling something or someone to one's advantage, often in a manner that is considered deceitful or unfair.

Synchronized De-escalation

A coordinated approach by all involved parties to progressively reduce tensions and conflict intensity in a systematic manner.

Tension Management

The practice of recognizing, addressing, and reducing stress or conflict in a situation to maintain or restore a state of equilibrium.

Q3: Can value can be created by waiting

Q10: The unlevered value of Aardvark's new project

Q11: The Free Cash Flow to Equity (FCFE)for

Q15: In 2005,assuming an average dividend payout ratio

Q17: Given that Rose issues new debt of

Q21: Which of the following statements regarding the

Q48: Which of the following statements is FALSE?<br>A)When

Q58: Which of the following statements is FALSE?<br>A)If

Q88: If Wyatt adjusts its debt once per

Q105: What is the expected payoff to equity