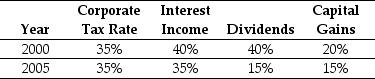

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Divergent Thinking

A thought process or method used to generate creative ideas by exploring many possible solutions.

Fleeting Inspiration

transient moments of creative or motivational spark that quickly come and go.

Redefining

The process of reinterpreting or reassigning meaning to a concept, term, or strategy, often to accommodate new information or perspectives.

Unique Solution

A distinctive or novel method for solving a problem or addressing a need.

Q5: What range for the market value of

Q8: Which of the following statements is FALSE?<br>A)A

Q29: The expected alpha for Taggart Transcontinental is

Q29: In order for Nielson Motors to be

Q36: The variance of the returns on the

Q68: Which of the following questions is FALSE?<br>A)With

Q71: If in the event of distress,the present

Q96: Suppose that you are holding a market

Q102: The required return for Sisyphean's new project

Q117: Consider a portfolio consisting of only Microsoft