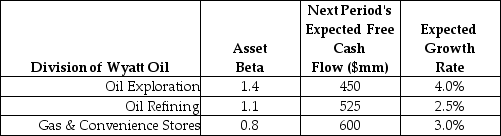

Use the following information to answer the question(s) below.  The risk-free rate of interest is 3% and the market risk premium is 5%.

The risk-free rate of interest is 3% and the market risk premium is 5%.

-The cost of capital for the oil exploration division is closest to:

Definitions:

Origin

The location or origin where something starts, originates, or is obtained from.

Genetic Diversity

The total number of genetic characteristics in the genetic makeup of a species, contributing to its ability to adapt to changing environments.

African Bushmen

Indigenous people primarily of the central and southern regions of Africa, known for their rich cultural heritage and hunter-gatherer lifestyle.

Human Genomes

The complete set of genetic material, including all genes and their sequences, in a human organism.

Q8: The amount that Ford Motor Company will

Q17: Which of the following statements is FALSE?<br>A)If

Q18: Which of the following statements is FALSE?<br>A)Given

Q26: The volatility of the alternative investment that

Q59: The beta for Taggart Transcontinental is closest

Q79: If you want to value a firm

Q82: Suppose that you want to use the

Q89: If its managers engage in empire building,then

Q90: Which of the following statements is FALSE?<br>A)Stock

Q100: Your estimate of the debt beta for