Use the following information to answer the question(s) below.

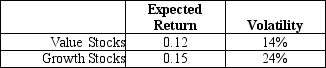

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Foreign Portfolio Investment

Investment in financial assets from another country, such as stocks or bonds, that does not grant the investor control over the business entities in which the investment is made.

U.S. Government Bonds

Securities issued by the United States Department of the Treasury to finance government spending.

Net Capital Outflow

The difference between a nation's savings and its domestic investments, representing international transfers of capital.

U.S. Assets

Assets located within the United States that may include real estate, stocks, bonds, and other financial instruments owned by individuals, companies, or the government.

Q2: With perfect capital markets,what is the market

Q35: Which of the following statements is FALSE?<br>A)A

Q38: Consider the following equation: E + D

Q42: The beta for the portfolio of the

Q67: Which firm has the most total risk?<br>A)Eenie<br>B)Meenie<br>C)Miney<br>D)Moe

Q72: Suppose that to raise the funds for

Q80: The average annual return on Stock A

Q81: Suppose you plan to hold Von Bora

Q82: In a world with taxes,which of the

Q107: Assuming the appropriate YTM on the Sisyphean