Use the following information to answer the question(s) below.

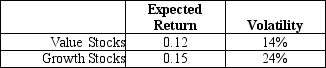

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Sex Ratio

The proportion of males to females in a population, which can influence mating behavior and social structure.

Ghalambor And Martin

Researchers known for their contributions to evolutionary biology and ecology, particularly in the context of adaptive variations in populations.

Parasitism Rates

The frequency or proportion at which parasitism occurs within a host population, affecting host dynamics and ecosystem relationships.

Parental Care

The investment made by parents in the survival of their offspring, which can include feeding, protection, and teaching of survival skills.

Q15: In 2005,assuming an average dividend payout ratio

Q16: The beta on Paul's portfolio is closest

Q17: Which of the following statements is FALSE?<br>A)If

Q42: Which of the following statements is FALSE?<br>A)Personal

Q47: The ai in the regression:<br>A)measures the sensitivity

Q48: Which of the following stocks represent buying

Q49: A group of portfolios from which we

Q70: Assuming that your capital is constrained,which investment

Q81: The payback period for project B is

Q88: The cost of capital for a project