Use the information for the question(s) below.

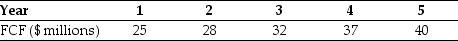

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $200 million of debt and 8 million shares of stock outstanding,then the share price for CCM is closest to:

Definitions:

Road To Serfdom

A book by Friedrich Hayek, published in 1944, warning of the potential dangers of government control leading to totalitarianism, arguing for the preservation of individual freedoms.

Laissez-Faire Economics

An economic philosophy of free-market capitalism that opposes government intervention.

Austrian-Born Economist

Refers to economists originating from Austria, particularly those associated with the Austrian School of Economics, known for emphasizing the importance of individual choice and spontaneous order in the economy.

Nazi Germany

The regime led by Adolf Hitler and the National Socialist German Workers' Party from 1933 to 1945, characterized by its totalitarian government and pursuit of aggressive expansion.

Q1: Portfolio "C":<br>A)is less risky than the market

Q17: Francisco d'Anconia is considering an investment opportunity

Q21: Your son is about to start kindergarten

Q24: The yield to maturity for the three-year

Q54: The standard deviation of the returns on

Q64: Using just the return data for 2009,your

Q69: What is the expected return for an

Q69: Which of the following statements is FALSE?<br>A)The

Q94: If the market risk premium is 6%

Q97: The cost of capital for the oil