Use the information for the question(s) below.

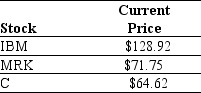

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-Suppose a security with a risk-free cash flow of $1000 one year from now trades for $909 today.If there are no arbitrage opportunities,then the current risk-free interest rate is closest to:

Definitions:

Perfect Competitor

A theoretical market structure where numerous small firms produce identical products, allowing no single firm to affect the market price.

Long Run

In economics, this term describes a period in which all factors of production and costs are variable, allowing full adjustment to any change.

Total Profit

The financial gain made after subtracting all expenses from total revenue.

Profit-Maximizing

A strategy or process employed by businesses to determine the price and output level that returns the highest profit.

Q14: Which of the following statements is FALSE?<br>A)Finding

Q25: Luther Corporation's stock price is $39 per

Q31: You are considering investing $600,000 in a

Q35: The ultimate goal of a customer relationship

Q44: Zoe Dental Implements has gross property,plant and

Q48: OrganicMeals Inc.is an American firm that manufactures

Q65: If the risk-free interest rate is 10%,then

Q71: What is an opportunity cost? Should it

Q88: The Sarbanes-Oxley Act (SOX)was passed by Congress

Q89: Wyatt Oil has a net profit margin