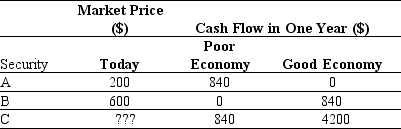

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

Definitions:

Long-term Potentiation

A lasting increase in signal transmission between two neurons, thought to be a biological mechanism behind learning and memory.

Synaptic Transmission

The process of transferring neurotransmitters from one neuron to another across a synapse to continue or modify a neural signal.

Information Processing

The series of actions or steps taken in order to store, retrieve, and make sense of information.

Mnemonic Devices

Tools or strategies used to improve memory by associating easy-to-remember constructs with complex information.

Q4: The break-even volume for a company is

Q9: Which of the following statements is FALSE?<br>A)U.S.Treasury

Q14: Which of the following statements is FALSE?<br>A)Finding

Q20: You work for a pharmaceutical company that

Q27: The brand equity of many oil companies

Q44: In a direct channel marketing system,_.<br>A)the manufacturer

Q49: The internal rate of return (IRR)for project

Q58: The profitability index for this project is

Q64: Which of the following statements is FALSE?<br>A)When

Q88: Which of the following statements is FALSE?<br>A)Bonds