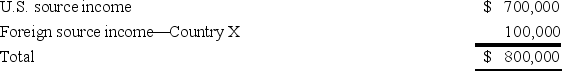

Global Corporation,a U.S.multinational,began operations this year.Global had pretax U.S.source income and foreign source income as follows:  Global paid $15,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Global paid $15,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Definitions:

Bacteria And Enzymes

Microorganisms and the catalyst proteins they produce, respectively, playing vital roles in environmental recycling, digestion, and numerous industrial processes.

Maritime Provinces

Refers to the Canadian provinces of Nova Scotia, New Brunswick, and Prince Edward Island, known for their coastal geography and historically significant maritime activities.

Population Trend

The general pattern of change in a population’s size, distribution, and composition over time, influenced by factors like birth and death rates.

Decreasing Population

A demographic trend where the number of individuals in a population lowers over time.

Q13: A business generates profit of $100,000.The owner

Q17: O&V sold a business asset with a

Q19: Perry Inc.and Dally Company entered into an

Q22: Investors must hold qualified small business stock

Q34: Employers must withhold state and federal income

Q41: For federal income tax purposes,property transfers pursuant

Q55: A foreign source dividend received by a

Q69: A fire destroyed business equipment that was

Q91: This year,Nilo Inc.granted incentive stock options (ISO)to

Q105: Reiter Inc.exchanged an old forklift for new