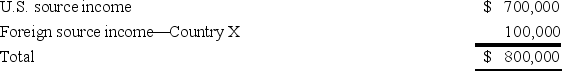

Global Corporation,a U.S.multinational,began operations this year.Global had pretax U.S.source income and foreign source income as follows:  Global paid $15,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Global paid $15,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Definitions:

Hypertension

A chronic medical condition in which the blood pressure in the arteries is persistently elevated, leading to increased risk of heart, brain, kidney, and other diseases.

Narcolepsy

A chronic sleep disorder characterized by overwhelming daytime drowsiness and sudden attacks of sleep.

Falls Asleep

The transition from wakefulness into sleep, a natural periodic state of rest for the mind and body.

Watching Television

The act of viewing content on a television set, an activity that can impact psychological and physical health in various ways.

Q12: Transfer prices cannot be used by U.S.corporations

Q21: Ted and Alice divorced in 2014.Pursuant to

Q33: Mr.Lee made the following transfers this year.Which

Q46: Gerry is the sole shareholder and president

Q49: Which of the following statements about boot

Q57: Fleming Corporation,a U.S.multinational,has pretax U.S.source income and

Q79: Which of the following statements about the

Q82: Tony's marginal income tax rate is 24%,and

Q96: Mr.Lexon owns investment property with a $719,000

Q102: Charlie is single and provides 100% of