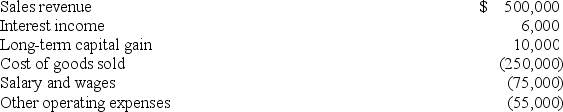

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year.If Mia has no other sources of income,what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year.If Mia has no other sources of income,what is her gross income for the year?

Definitions:

Group Technique

A method or strategy used to improve group interaction, effectiveness, and goal achievement, often employed in therapeutic or organizational settings.

Family Systems Therapy

A therapeutic approach that treats individuals within the context of their family units, emphasizing family relationships as an important factor in psychological health.

Person-centered Interviews

Interview techniques focusing on the interviewee, allowing them to express themselves freely and fully.

Self-reports

A method of data collection in which individuals provide information about themselves, often used in psychological assessments and research.

Q13: Stanley Inc.,a calendar year taxpayer,purchased a building

Q17: Which of the following statements regarding S

Q21: Which of the following statements describing individual

Q22: An individual's taxable income equals adjusted gross

Q29: Waters Corporation is an S corporation with

Q39: Welch Inc.has used a fiscal ending September

Q40: Earl Company uses the accrual method of

Q73: A corporation can't have an increase in

Q83: Pratt Inc.reported $198,300 book depreciation on its

Q110: International tax treaties generally allow a government