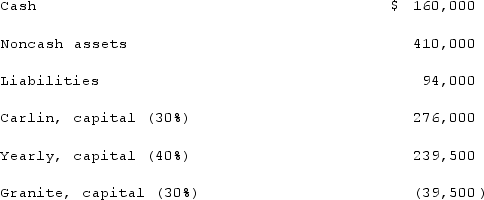

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:  The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

Definitions:

Emperor of the West

Historically refers to the ruler of the Western Roman Empire, specifically after its division from the Eastern Empire.

Honorius

A Roman Emperor of the West (395-423 AD) known for his reign during the period of the empire's decline in the face of Visigothic invasions and internal strife.

Constantinople

The historical name for the modern city of Istanbul from its founding in 330 AD until the Ottoman conquest in 1453, serving as the capital of the Byzantine Empire.

Milan

A city in Northern Italy, recognized as a leading global fashion and design capital, with a rich history in art and architecture.

Q2: A highly inflationary economy is defined as<br>A)

Q8: Describe the two parts of the SEC

Q19: On December 1, 2021, Keenan Company, a

Q24: What is a proxy? Briefly explain the

Q36: Jackson Corp. (a U.S.-based company) sold parts

Q42: A foreign subsidiary of a U.S.-based company

Q52: All of the following are ways a

Q110: How can the influence of a third

Q197: Suppose that to move more people off

Q449: Which of the following is counted as