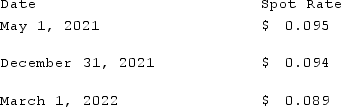

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Exit Interviews

A survey or interview conducted with departing employees to gain insights into their experiences, reasons for leaving, and suggestions for improving the workplace.

Job Descriptive Indices

A validated survey instrument used to measure employees' satisfaction with various aspects of their jobs.

Job Satisfaction

The level of contentment employees feel about their work, which can affect productivity and morale.

Upper-level Managers

Senior executives within an organization responsible for making strategic decisions and overseeing the entire operation or significant parts of it.

Q2: Lucky Co. had cash of $65,000, inventory

Q48: What are free assets?<br>A) Assets for which

Q52: Hardin, Sutton, and Williams have operated a

Q62: On March 1, 2021, Mattie Company received

Q66: On January 1, 2020, Mace Co. acquired

Q71: What are some of the reasons for

Q92: Under current U.S. tax law for consolidated

Q102: Which of the following is not correct

Q104: On January 1, 2020, Jones Company bought

Q113: Fargus Corporation owned 51% of the voting