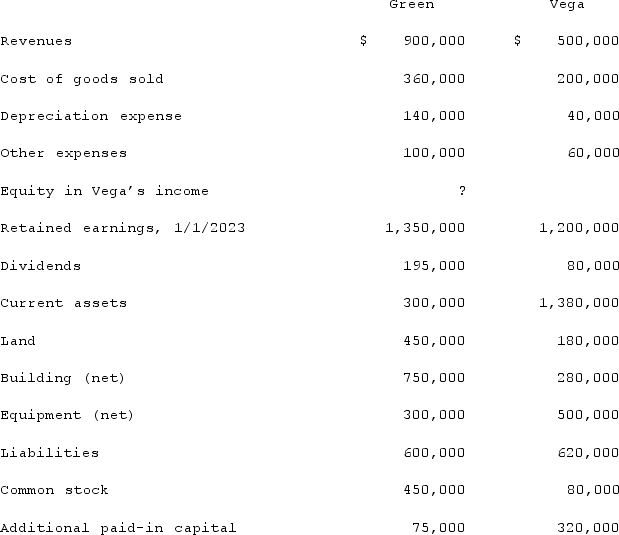

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Definitions:

Pollution

The presence of substances in the environment that are harmful to human health, natural ecosystems, or the climate.

Output

The total amount of products or services produced by a company, industry, or economy.

Marginal External Costs

The additional cost imposed on third parties not involved in a transaction or decision, for each additional unit produced or consumed.

Peach Canners

Peach canners are production facilities or workers involved in preserving peaches by canning them, which involves processing, sealing in an airtight container, and sterilizing to extend shelf life.

Q14: Flynn acquires 100 percent of the outstanding

Q49: When a company applies the initial value

Q74: Harrison, Inc. acquires 100% of the voting

Q79: McGuire Company acquired 90 percent of Hogan

Q89: On January 3, 2021, Madison Corp. purchased

Q95: Jaynes Inc. acquired all of Aaron Co.'s

Q101: On January 1, 2021, the Moody Company

Q112: On January 4, 2020, Nelson Corporation purchased

Q119: Which of the following refers to the

Q123: Kenzie Co. acquired 70% of McCready Co.