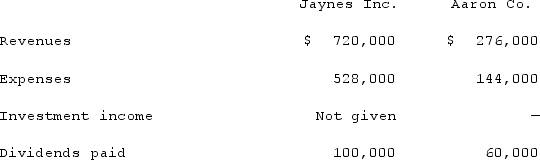

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

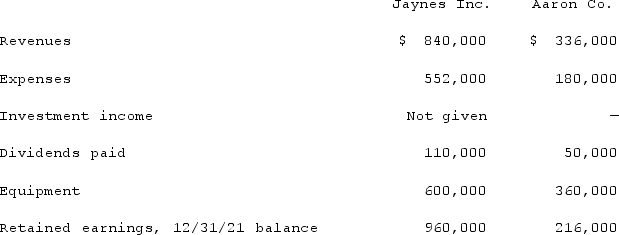

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2021, when the equity method was applied for this acquisition?

Definitions:

DNA

Deoxyribonucleic acid, a self-replicating material present in nearly all living organisms as the main constituent of chromosomes, carrier of genetic information.

Evolutionary Advantage

A trait or characteristic that increases an organism's likelihood of survival and reproduction in its environment.

Subliminal Perception

The process of receiving information below the level of conscious awareness, which can influence thoughts, feelings, or actions without the individual's conscious recognition.

Pituitary Gland

The Pituitary Gland is a small, pea-sized gland at the base of the brain, important in controlling growth, metabolism, and the function of other glands in the endocrine system.

Q1: What argument could be made against the

Q30: If new bonds are issued from a

Q31: Watkins, Inc. acquires all of the outstanding

Q47: Pell Company acquires 80% of Demers Company

Q48: Anderson Company, a 90% owned subsidiary of

Q63: McGuire Company acquired 90 percent of Hogan

Q67: _ is a price tactic that charges

Q71: Under the partial equity method, the parent

Q73: On January 1, 2021, Pride, Inc. acquired

Q112: Which of the following statements best defines