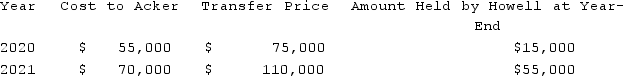

Acker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows:  Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the Equity in Howell Income that should be reported by Acker in 2021?

Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the Equity in Howell Income that should be reported by Acker in 2021?

Definitions:

Mortgage

A legal agreement whereby a lender lends money at interest in exchange for taking title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

Monthly Payments

Regular payments made over a specified period of time, often used in the context of loan repayments or rental agreements.

Times Interest Earned

A financial metric indicating how well a company can cover its debt payments, by comparing its earnings before interest and taxes against its interest expenses.

Income Before Taxes

A company’s total earnings or profit before income tax expense has been deducted.

Q6: Impersonal,one-way mass communication about a product or

Q6: Which of the following indicates the final

Q43: In designing an effective social media plan,which

Q45: How would you account for in-process research

Q53: Buzz is a social media metric based

Q67: Advocacy advertising is a form of product

Q89: Which of the following statements is true

Q109: _ is a form of institutional advertising.<br>A)

Q110: Which of the following is a characteristic

Q114: On January 1, 2019, Rand Corp. issued