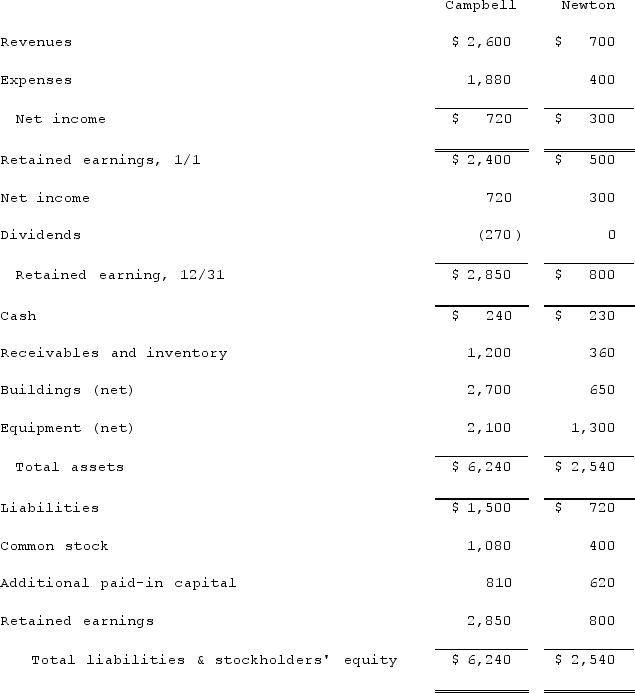

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

Definitions:

Wavenumber

A unit of frequency used in spectroscopy, representing the number of waves per unit distance.

Arrow Pushing

A technique used in organic chemistry to describe the movement of electrons during chemical reactions.

Formal Charges

A bookkeeping tool used in chemistry to account for the distribution of electrons among atoms in a molecule, helping to identify the most stable resonance form.

Nucleophilic Acyl Substitution

A reaction where a nucleophile replaces the leaving group in an acyl compound.

Q25: The financial statements for Campbell, Inc., and

Q32: On January 1, 2021, the Moody Company

Q34: On January 3, 2021, Roberts Company purchased

Q54: Traditional advertising provides more sophisticated methods of

Q55: On January 1, 2019, Palk Corp. and

Q60: The following are preliminary financial statements for

Q63: Consumers determine value of the product on

Q66: In which stage of the product life

Q72: Personal selling should be directed toward all

Q104: Following are selected accounts for Green Corporation