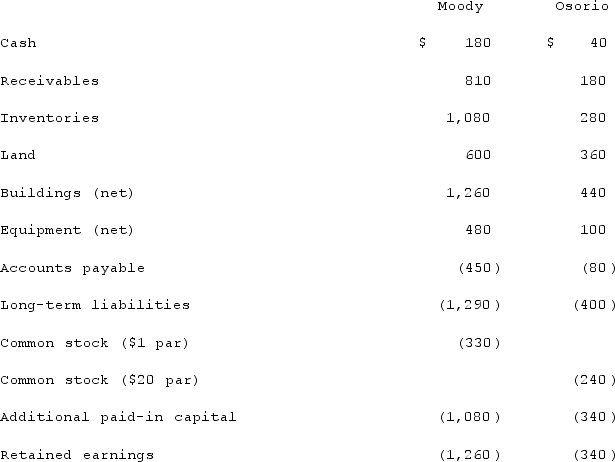

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Corporation

A legal entity recognized by law that is separate from its owners, with the ability to own assets, incur liabilities, and sell shares to investors.

Assets

Resources owned or controlled by a business, expected to produce economic value or benefits in the future.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or decline in value.

Amortization Expense

The process of allocating the cost of an intangible asset over its useful life for accounting and tax purposes.

Q1: Which of the following statements is true

Q32: On January 1, 2021, the Moody Company

Q33: When a parent company acquires a less-than-100

Q48: Farah Corp. purchased 35% of the common

Q57: On January 3, 2020, Baxter, Inc. acquired

Q60: The following are preliminary financial statements for

Q60: A publicly accessible web page that serves

Q70: Chase Incorporated sold $260,000 of its inventory

Q75: Parsons Company acquired 90% of Roxy Company

Q122: The financial statement amounts for the Atwood