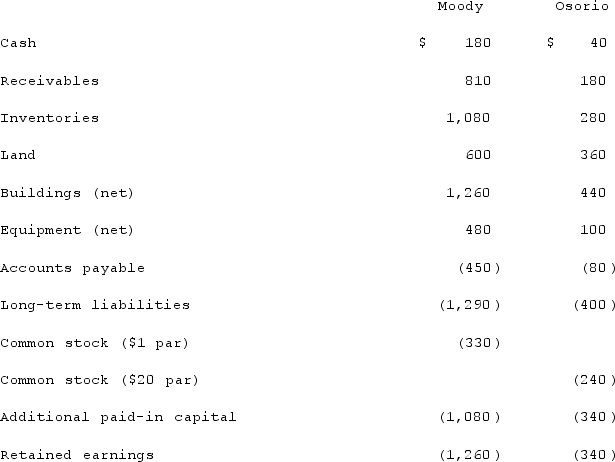

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated land at date of acquisition.

Definitions:

Salespeople Difficulties

Challenges faced by sales professionals, including rejection, meeting sales targets, and managing customer expectations.

Summary-of-benefits

A concise presentation or list detailing the advantages or positive outcomes of a product, service, or proposal.

Indecisive Prospect

A potential customer who is hesitant or struggles to make a purchasing decision, often requiring additional information or reassurance from a salesperson.

Negotiation Close

A sales technique where the salesperson seeks to conclude a deal by negotiating terms that are acceptable to both the buyer and seller.

Q14: Flynn acquires 100 percent of the outstanding

Q23: Ryan Company purchased 80% of Chase Company

Q39: Relationship selling is more often used in

Q60: A publicly accessible web page that serves

Q60: The newly opened Stone Restaurant was unable

Q66: When an investor appropriately applies the equity

Q78: Which of the following is the second

Q92: The financial statement amounts for the Atwood

Q102: McCoy has the following account balances as

Q114: On January 4, 2020, Nelson Corporation purchased