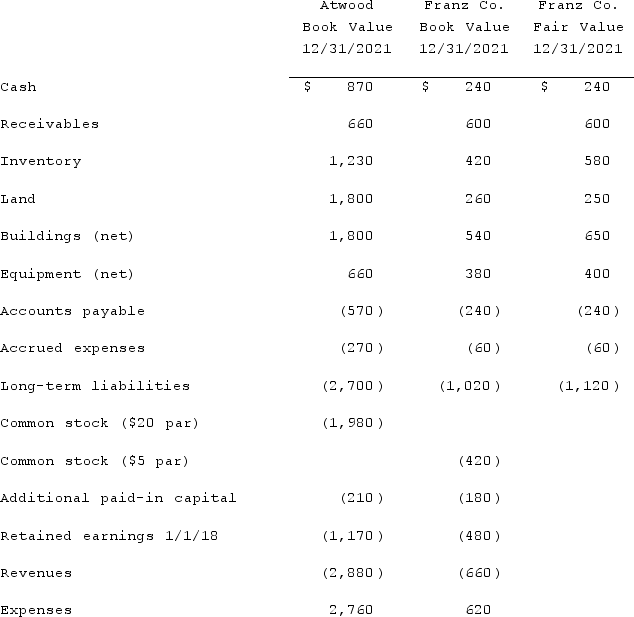

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated revenues immediately following the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated revenues immediately following the acquisition.

Definitions:

True Value

The actual, inherent worth of an item or phenomenon, often considered in contrast to its market value or perceived value.

Bidders

Individuals or entities that offer to pay a certain price for goods, services, or assets in an auction or competitive bidding process.

Common-value Auction

An auction format where the item for sale has a value that is essentially the same for all bidders, but the bidders may have different information about that value.

Oral Auctions

Auctions where bids are made verbally, allowing for real-time, competitive bidding among participants.

Q6: Impersonal,one-way mass communication about a product or

Q16: When recruiting the sales force,sales managers prefer

Q24: Thomas Inc. had the following stockholders' equity

Q26: Fargus Corporation owned 51% of the voting

Q33: When is a goodwill impairment loss recognized?<br>A)

Q69: Flynn acquires 100 percent of the outstanding

Q71: On January 1, 2021, the Moody Company

Q84: During 2020, Odyssey Co. sold inventory to

Q116: When an investor sells shares of its

Q118: Which of the following statements regarding consolidation