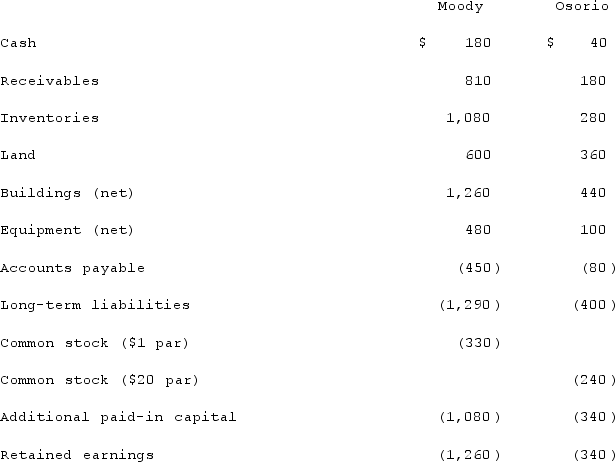

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Cultural Effects

The influence that culture has on the behavior and beliefs of individuals within that culture.

Win-Win Attitude

An approach to conflict resolution and negotiation where all parties work together to find a solution that satisfies everyone's interests.

Mediators

Neutral third parties who facilitate negotiations and conflict resolution between disputing parties aiming for agreement.

Competencies

Skills and abilities that enable an individual to perform tasks successfully.

Q1: Wilkins Inc. acquired 100% of the voting

Q16: When recruiting the sales force,sales managers prefer

Q19: Walsh Company sells inventory to its subsidiary,

Q39: What are the primary sources of information

Q66: A current sales practice that involves building,maintaining,and

Q85: The social media users who maintain a

Q110: Which of the following statements is true

Q111: On January 1, 2020, Archer, Incorporated, paid

Q119: Flynn acquires 100 percent of the outstanding

Q130: A price tactic that requires the buyer