Note: This is a Kaplan CPA Review Question

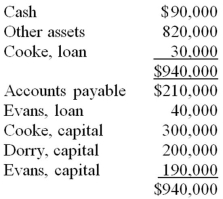

The following condensed balance sheet is presented for the partnership of Cooke, Dorry, and Evans who share profits and losses in the ratio of 4:3:3, respectively:

Assume that the partners decide to liquidate the partnership. If the other assets are sold for $600,000, how much of the available cash should be distributed to Cooke?

Definitions:

Parents

The mother and father or legal guardians of a child, responsible for their caretaking and upbringing.

Children

Young human beings, specifically individuals from birth to adolescence.

Self-Centered

Having an undue focus on oneself, one's own desires, needs, and interests, often at the expense of others.

Medical Doctor

A qualified practitioner of medicine; a physician who has completed training in medical school and earned a professional degree.

Q6: Infinity Corporation acquired 80 percent of the

Q7: Which combination of fund and measurement basis

Q15: Note: This is a Kaplan CPA Review

Q21: Each of the following questions names an

Q24: Which of the following describes how a

Q28: Catalyst Corporation acquired 90 percent of Trigger

Q37: Note: This is a Kaplan CPA Review

Q38: On December 1, 20X8, Winston Corporation acquired

Q45: On January 2, 20X8, Johnson Company acquired

Q52: Note: This is a Kaplan CPA Review