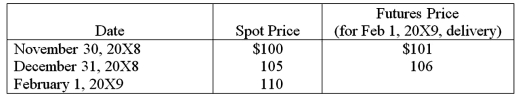

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

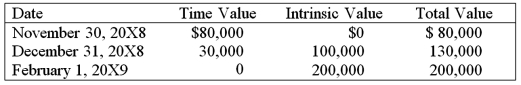

The information for the change in the fair value of the options follows:

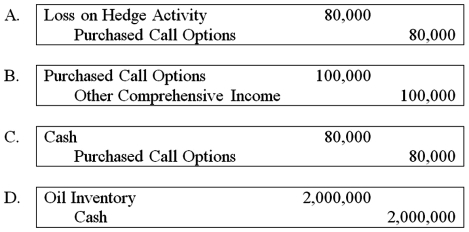

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information, which of the following entries will be required on February 1, 20X9?

Definitions:

Whistleblowers

Individuals who expose illegal or unethical conduct within an organization.

Retaliatory Actions

Measures taken in response to an offense or wrongdoing, often with the intent of inflicting punishment or seeking justice.

Social Responsibility

A duty every individual or organization has to perform so as to maintain a balance between the economy and the ecosystems.

Corporate Profits

The surplus amount a company earns after deducting all its expenses, which reflects the financial health and operational success of the business.

Q1: Five of eight internally reported operating segments

Q7: Required financial statements of funds may include

Q15: Note: This is a Kaplan CPA Review

Q22: Each of the following questions names an

Q43: The Town of Pasco has no supplies

Q48: Note: This is a Kaplan CPA Review

Q58: Rebecca was dissatisfied with her life. She

Q61: Note: This is a Kaplan CPA Review

Q61: Feminist theory suggests that_ differences shape our

Q67: When a capital projects fund transfers a