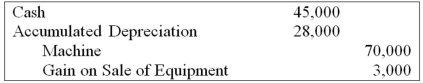

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:  Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information, in the preparation of the 20X9 consolidated income statement, depreciation expense will be:

Definitions:

Fraudulent Misrepresentations

False statements made with the intent to deceive, which leads someone to enter into a contract to their detriment.

Joint Ventures

Business arrangements where two or more parties agree to pool resources for a specific project or business activity.

Foreign Investors

Individuals or entities from one country investing in the assets or businesses of another country.

Mutual Mistake

An error shared by all parties to a contract, possibly making the agreement voidable.

Q4: _is the separation of our role playing

Q14: Taste Bits Inc. purchased chocolates from Switzerland

Q19: Denver Corporation owns 25 percent of the

Q27: In_ view, bureaucracy is inescapable but not

Q32: On January 1, 20X9, A Company acquired

Q36: Lloyd Corporation reports the following information for

Q47: On January 1, 20X7, Servant Company purchased

Q52: All of the following situations require a

Q61: On December 1, 20X8, Hedge Company entered

Q89: Herman visited Egypt, and while standing on