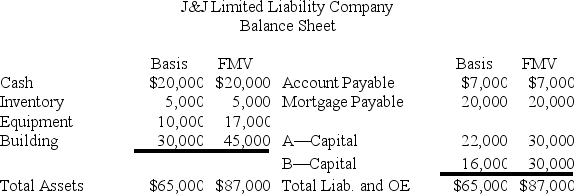

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Psychodynamic Theories

A framework in psychology that emphasizes the role of unconscious processes and childhood experiences in shaping personality and behavior.

Trait Theories

The study of human personality focused on identifying and measuring the stable characteristics that distinguish one individual from another.

Reciprocal Determinism

A concept in psychology that suggests an individual's behavior is both influenced by and influences their personal factors and the environment in a cyclical manner.

Spotlight Effect

The perception that people are paying more attention to one's appearance and behavior than they really are.

Q7: The "family attribution" rules are automatically waived

Q23: Which of the following items is not

Q30: Barry has a basis in his partnership

Q39: In January 2019, Khors Company issued nonqualified

Q44: An S corporation shareholder calculates his initial

Q50: An S corporation can make a voluntary

Q73: This year, Reggie's distributive share from Almonte

Q102: RGD Corporation was a C corporation from

Q106: Public Law 86-272 was a congressional response

Q109: Parker is a 100 percent shareholder of