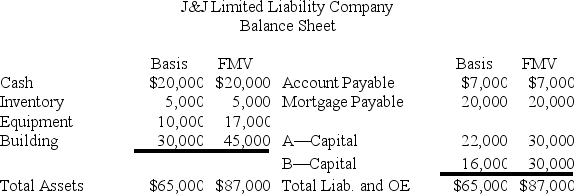

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Definitions:

Psychoanalytic Theory

A set of theories originating with Sigmund Freud that emphasizes unconscious psychological processes and contends that childhood experiences significantly influence adult personality and behavior.

Symbolic Interaction Theory

A theoretical perspective claiming that people act toward things because of the meaning things have for them.

Identity

How one defines oneself.

Looking-glass Self

A concept in sociology suggesting that an individual's self-awareness and self-identity are shaped by how they perceive others view them.

Q19: A distribution from a corporation to a

Q23: Lefty provides demolition services in several southern

Q32: Which of the following statements is true

Q34: John, a limited partner of Candy Apple,

Q45: During 2019, CDE Corporation (an S corporation

Q55: The deduction for qualified business income applies

Q75: Which of the following is allowable as

Q92: In 2019, US Sys Corporation received $250,000

Q96: Publicly traded companies usually file their financial

Q100: The PW Partnership's balance sheet includes the