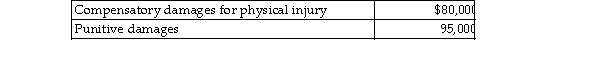

Derrick was in an automobile accident while he was going to work. The doctor advised him to stay home for eig months due to his physical injuries. The resulting lawsuit was settled and Derrick received the following amount  How much of the settlement must Derrick include in ordinary income on his tax return?

How much of the settlement must Derrick include in ordinary income on his tax return?

Definitions:

Meiosis

A type of cell division that reduces the chromosome number by half, creating four haploid cells, each genetically distinct from the parent cell that gave rise to them.

Gene Dominance

A phenomenon in genetics where one allele masks the expression of another allele in determining phenotypic traits.

Condition Passed

The state of having moved beyond a particular condition, problem, or stage, often implying improvement or resolution.

Vulnerability-Stress Perspective

A theory suggesting that psychopathology develops due to a combination of genetic vulnerabilities and environmental stressors.

Q107: Itemized deductions are deductions for AGI.

Q955: Lester, a widower qualifying as a surviving

Q972: Allison buys equipment and pays cash of

Q979: If a loan has been made to

Q1089: During the current year, Tony purchased new

Q1126: Greg is the owner and beneficiary of

Q1634: Payments received from a workers' compensation plan

Q2184: Ella is a cash- basis sole proprietor

Q2199: Insurance proceeds received because of the destruction

Q2225: Mitzi's 2018 medical expenses include the following: