An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

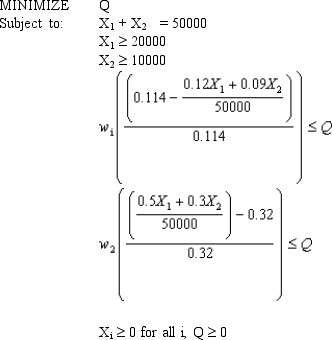

The following Excel spreadsheet has been created to solve a goal programming problem with a MINIMAX objective based on the following goal programming formulation with MINIMAX objective and corresponding solution.

with solution (X1, X2) = (15,370, 34,630).

with solution (X1, X2) = (15,370, 34,630).

What values should go in cells B2:D14 of the spreadsheet?

Definitions:

Inertia

A physical principle stating that an object will remain at rest or in uniform motion in a straight line unless acted upon by an external force.

Momentum

The quantity of motion of a moving body, measured as a product of its mass and velocity.

Horsepower

A rating of the amount of work performed by an engine. Originally based on the amount of weight a horse could move in one minute. One HP is equal to about 746 watts.

Wet Sump System

An oil management system used in internal combustion engines where the oil is stored in a sump directly beneath the engine and pumped where needed.

Q17: An investor wants to determine how much

Q22: The _ in a decision problem represent

Q25: Refer to Exhibit 3.1. Which cells should

Q28: If a company selects Project 1

Q35: Refer to Exhibit 3.4. What formula should

Q42: The hospital administrators at New Hope,

Q54: Refer to Exhibit 11.4. What formula should

Q57: Refer to Exhibit 13.2. What is the

Q63: A binding greater than or equal

Q63: Which Risk Solver Platform (RSP) function will