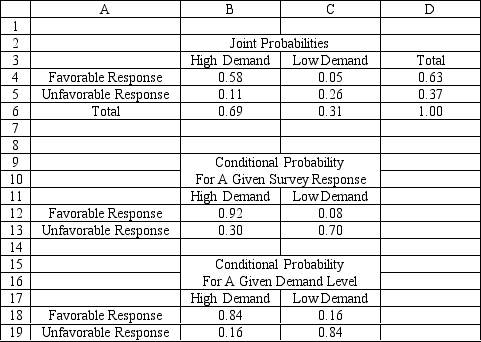

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

-Refer to Exhibit 14.6. What is P( ) , where F = favorable response and H = high demand?

) , where F = favorable response and H = high demand?

Definitions:

Conservatively

Acting with caution, prudence, or in a manner that tends to preserve existing conditions or to minimize risk.

Privacy

The state or condition of being free from being observed or disturbed by other people.

Person Perception

The process of forming impressions and making judgments about the characteristics and motives of others.

Physical Appearance

Relates to the outer look or presentation of individuals, including factors such as dress, grooming, body shape, and facial features.

Q4: POS scanning is used to initiate a

Q6: Project 12.1- Monte Carlo Integration<br>A common application

Q11: The concept of focus in location decisions

Q25: Refer to Exhibit 14.6. What is P(F<font

Q32: A major flaw in critical path analysis

Q37: A shortcoming of simulation is the use

Q39: The usual range of the smoothing constant

Q40: An arrival process is memoryless if<br>A) the

Q54: Why would a manager be interested in

Q56: Refer to Exhibit 10.7. What formulas should