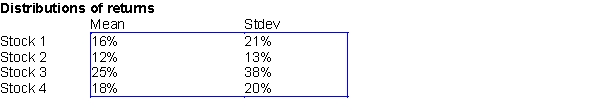

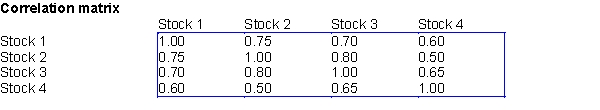

Suppose that Ms. Smart invests 25% of her portfolio in four different stocks. The mean and standard deviation of the annual return on each stock are shown in the first table below. The correlations between the annual returns on the four stocks are shown in the second table below.

-(A) Use @RISK with 100 replications, provide a summary statistics of portfolio return; namely, minimum, maximum, mean, and standard deviation.

(B) Use your answers to (A) to estimate the probability that Mrs. Smart's portfolio's annual return will exceed 20%.

(C) Use your answers to (A) to estimate the probability that Mrs. Smart's portfolio will lose money during the course of a year.

(D) Suppose that the current price of each stock is as follows: stock 1: $16; stock 2: $18; stock 3: $20; and stock 4: $22. Ms. Smart has just bought an option involving these four stocks. If the price of stock 1, six months from now are is $18 or more, the option enables Ms. Smart to buy, if she desires, one share of each stock for $20 six months from now. Otherwise the option is worthless. For example, if the stock prices six months from now are: stock 1: $18; stock 2: $20; stock 3: $21; and stock 4: $24, then Ms. Smart would exercise her option to buy stocks 3 and 4 and receive (21- 20) + (24-20) = $5 in each cash flow. How much is this option worth if the risk-free rate is 8%?

Definitions:

Transform Fault

A type of fault where two tectonic plates slide past one another horizontally, often causing earthquakes.

Lahars

Volcanic mudflows or debris flows composed of a slurry of pyroclastic material, rocky debris, and water, that flow down from a volcano, often following a volcanic eruption.

Basaltic Lava

A type of molten rock that is low in silica and flows easily, typically forming smooth, broad volcanic features.

Shield Volcano

A type of volcano with broad, gently sloping sides, built by the eruption of low-viscosity lava that can flow long distances.

Q7: Which methodology is used to group products

Q9: In a multiplicative seasonal model, we multiply

Q9: Priti is wondering whether time of day

Q19: Suppose you run a simulation model several

Q34: Approximate the percentage of these Internet users

Q35: Find the expected demand (in units) for

Q49: The percentage of variation explained, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1387/.jpg"

Q81: What can you say about the relative

Q83: (A) Determine how to minimize the cost

Q95: The number of cars produced by GM