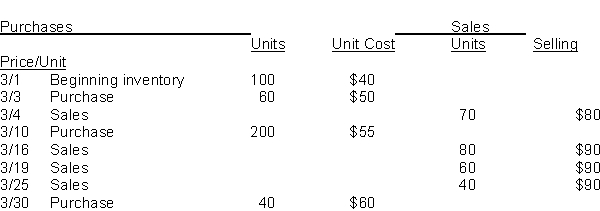

Lester Company sells many products. Hackenberry is one of its popular items. Below is an analysis of the inventory purchases and sales of Hackenberry for the month of March. Lester Company uses the periodic inventory system.  Instructions

Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the weighted average method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

Definitions:

Process Costing

A costing method used in manufacturing where costs are assigned to batches or production runs, typically for homogeneous products.

Cost of Goods Completed

This term refers to the total cost incurred to manufacture products that have been completed during a specific period.

Processing Department

A division within a factory where a specific type of production activity or process takes place.

Work in Process

Inventory category referring to goods that are in the process of being manufactured but are not yet completed.

Q9: The _ of an asset should not

Q10: Vance Company reported the following summarized annual

Q28: Cash equivalents could include each of the

Q99: An employee authorized to sign checks should

Q119: Bell Food Store developed the following information

Q175: Company X sells $900 of merchandise on

Q186: The following items are taken from

Q197: The controller of Alt Company is applying

Q207: McKendrick Shoe Store has a beginning inventory

Q216: FIFO and LIFO are the two most