Pine Company owns an 80% interest in Salad Company and a 90% interest in Tuna Company.During 2013 and 2014, intercompany sales of merchandise were made by all three companies.Total sales amounted to $2,400,000 in 2013, and $2,700,000 in 2014.The companies sold their merchandise at the following percentages above cost.

Pine 15%

Salad 20%

Tuna 25%

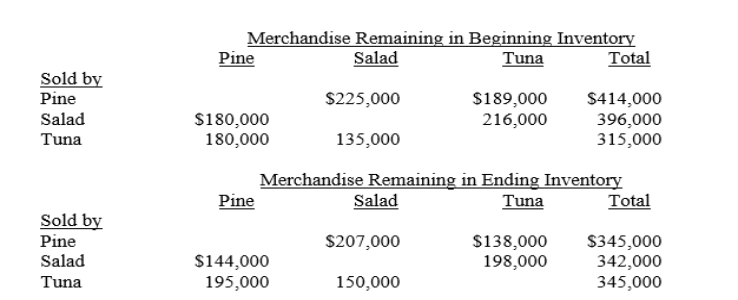

The amount of merchandise remaining in the 2014 beginning and ending inventories of the companies from these intercompany sales is shown below.

Reported net incomes (from independent operations including sales to affiliates) of Pine, Salad, and Tuna for 2014 were $3,600,000, $1,500,000, and $2,400,000, respectively.

Required:

A.Calculate the amount noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2014.

B.Calculate the controlling interest in consolidated net income for 2014.

Definitions:

Confidence Interval

A confidence interval is a range of values, derived from sample data, that is likely to contain the value of an unknown population parameter, expressed with a certain level of confidence.

Employee Stock Ownership Plan

A program that provides a company's workforce with an ownership interest in the company, usually in the form of stock options or shares.

Stock Options

Financial instruments that give an employee the right to buy or sell the company's stock at a predetermined price within a specific period.

Scanlon Plan

A participative management approach that focuses on improving productivity and sharing the resulting cost savings with employees.

Q9: On the consolidated statement of cash flows,

Q15: The goals of the International Accounting Standards

Q16: Which of the following would be restated

Q18: The following information pertains to the transfer

Q20: Prince Company owns 104,000 of the 130,000

Q47: Capital expenditure proposals are initially screened by

Q81: The net present value method can only

Q89: A company's cost of capital refers to

Q122: Intangible benefits in capital budgeting<br>A)should be ignored

Q132: Budget reports provide the feedback needed by