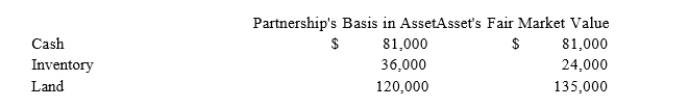

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:  What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Image

A representation or likeness of an object produced on a surface by light waves or captured through photography.

Echoic Memory

A component of sensory memory that holds auditory information, allowing sounds to be remembered for short periods after they are heard.

Iconic Memory

A type of visual sensory memory that holds a brief photographic image for a split second before it fades.

Meaningful Conversations

Exchanges that go beyond superficial topics, involving deep and significant subjects that contribute to stronger connections and understanding between the participants.

Q33: Which of the following statements is true

Q50: Federico is a 30% partner in the

Q52: Lloyd and Harry, equal partners, form the

Q56: BPA Partnership is an equal partnership in

Q57: Sarah, Sue, and AS Inc. formed a

Q90: Emerald Corporation is a 100 percent owned

Q90: Leslie made a mathematical mistake in computing

Q92: A calendar-year corporation has positive current E&P

Q106: S corporations generally recognize gain or loss

Q124: For S corporations without earnings and profits