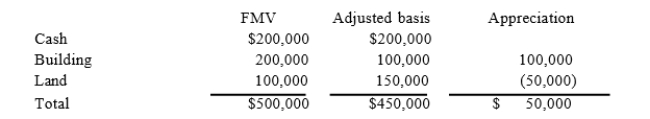

Mike and Michelle decided to liquidate their jointly owned corporation, Pennsylvania Corporation. Afterliquidating its remaining inventory and paying off its remaining liabilities, Pennsylvania had the following tax accounting balance sheet.  Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is$100,000.What amount of gain or loss does Pennsylvania recognize in the complete liquidation?

Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is$100,000.What amount of gain or loss does Pennsylvania recognize in the complete liquidation?

Definitions:

Golden Cities

Symbolic or mythic representations of utopian urban areas that offer prosperity, opportunity, and an ideal living environment, often used in literature and lore.

Spanish Explorations

Periods of exploration led by Spain, primarily during the 15th to 17th centuries, aimed at discovering new territories and establishing Spanish colonies.

US. Southwest

A geographic region of the United States that includes parts of Arizona, New Mexico, Texas, and California, known for its desert landscapes, rich cultural heritage, and significant Native American populations.

Exterminate

To completely destroy or eliminate a group, species, or population, often used in contexts of war, genocide, or pest control.

Q2: Marcella has a $65,000 basis in her

Q17: Martha is a 40% partner in the

Q20: Daniel acquires a 30% interest in the

Q31: John, a limited partner of Candy Apple,

Q52: Lloyd and Harry, equal partners, form the

Q54: A single-member LLC is taxed as a

Q55: Jalen transferred his 10 percent interest to

Q75: Which of the following statements regarding deductions

Q95: Potter, Inc. reported pretax book income of

Q127: For incentive stock options granted when ASC