Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

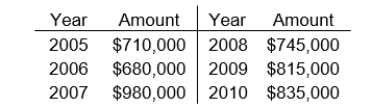

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-Estimated goodwill by capitalizing average excess earnings at 14% is

Definitions:

Ending Inventory Cost

The total value of all goods available for sale at the end of an accounting period, calculated using a specific inventory costing method like FIFO or LIFO.

Physical Inventory

A process of counting and verifying the actual inventory on hand at a specific time, typically used to validate inventory records and adjust discrepancies.

Periodic System

An inventory tracking system that updates inventory balances after a specific period, based on physical inventory counts.

First-In

Often used in the context of inventory management, "First-In" refers to goods that were acquired or produced first being sold, used, or disposed of first.

Q4: Which of the following does not describe

Q5: Which of the following does not correctly

Q9: The single-step income statement emphasizes<br>A)the gross profit

Q28: Borrowing cost that are capitalized should<br>A)be written

Q29: The widely publicized subprime lending crisis was

Q34: Earnings management is<br>A)the process of managing a

Q48: The concept of a constructive obligation in

Q60: Jakob Corporation uses the fair value model

Q61: The revaluation model of accounting for PP&E

Q143: Shareholders are most interested in evaluating<br>A)liquidity.<br>B)solvency.<br>C)profitability.<br>D)marketability.<br>