SCENARIO 11-2

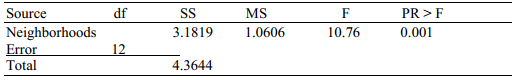

A realtor wants to compare the mean sales-to-appraisal ratios of residential properties sold in four neighborhoods (A,B,C,and D) .Four properties are randomly selected from each neighborhood and the ratios recorded for each,as shown below.

A: 1.2,1.1,0.9,0.4

C: 1.0,1.5,1.1,1.3

B: 2.5,2.1,1.9,1.6

D: 0.8,1.3,1.1,0.7

Interpret the results of the analysis summarized in the following table:

-Referring to Scenario 11-2,what should be the conclusion for the Levene's test for homogeneity of variances at a 5% level of significance?

Definitions:

Tax Liability

The total amount of tax owed by an individual, corporation, or other entity to the taxing authority.

Proportional Tax Rate

A tax system where the tax rate remains constant regardless of the amount of income, meaning the tax evolves proportionally with income.

Tax Base

The total amount of assets or revenue that a government can tax, used to determine the tax rate needed to raise required revenues.

Form 1040EZ

A simplified tax form for individuals in the United States who have a straightforward tax situation, enabling a faster filing process. (Note: As of my last update, Form 1040EZ has been discontinued and replaced by a redesigned Form 1040.)

Q31: How many tissues should the Kimberly

Q53: Referring to Scenario 8-10,construct a 95% confidence

Q53: Referring to Scenario 10-13,suppose α = 0.05.Which

Q54: The value of r is always positive.

Q66: Referring to Scenario 8-7,a 99% confidence interval

Q78: A powerful women's group has claimed that

Q127: Referring to Scenario 11-5,the within-group variation or

Q144: Referring to Scenario 12-5,there is sufficient evidence

Q158: Referring to Scenario 13-10,what are the values

Q169: Referring to Scenario 13-8,the value of the