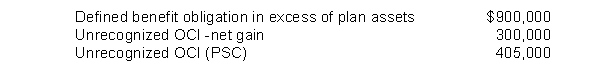

Presented below is information related to Decker Manufacturing Company as of December 31, 2011:

The amount for the past service cost is related to an increase in benefits.The fair value of the pension plan assets is $600,000.

The pension asset \ liability reported on the statement of financial position at December 31, 2011 is

Definitions:

Variable Factory Overhead Controllable Variance

The difference between the actual variable overhead costs incurred and the standard variable overhead expenses expected, which can be controlled or influenced by management.

Standard Factory Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production, based on a certain base such as labor hours or machine hours.

Direct Labor Hour

A measure of the amount of time an employee spends producing goods or services, directly associated with the product's cost.

Normal Capacity

Represents the average production level expected over a specific period under normal operating conditions.

Q2: Stephens Company has a deductible temporary difference

Q7: What is the amount of depreciation expense

Q17: Under the operating method, the lessor records

Q24: An executive pays no taxes at time

Q27: All of the following are procedures for

Q40: The IASB requires that investments meeting the

Q46: Permanent differences do not give rise to

Q49: Hook Company leased equipment to Emley Company

Q55: During 2012, Gordon Company issued at 104

Q95: What is the price-earnings ratio for Sealy