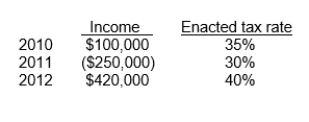

Use the following information for questions.

Operating income and tax rates for C.J.Company's first three years of operations were as

follows:

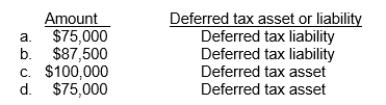

-Assuming that C.J.Company opts only to carryforward its 2011 NOL, what is the amount of deferred tax asset or liability that C.J.Company would report on its December 31, 2011 balance sheet?

Definitions:

Physiological Component

Refers to the aspects of processes, functions, and activities of living organisms that can be measured and studied.

Cognitive Component

In psychology, the aspect of attitude that involves a person’s beliefs or knowledge about an object, person, or situation.

Behavioural Component

Refers to the observable actions or reactions of an individual in response to external or internal stimuli.

Perceptual Component

An essential part of perception involving the interpretation and organization of sensory information to understand an object or event.

Q5: In computing the present value of the

Q19: The gross profit amount in a sales-type

Q19: Depreciation expense for 2011 was<br>A)$258,000.<br>B)$234,000.<br>C)$54,000.<br>D)$36,000.

Q40: On January 1, 2012, Trent Company granted

Q59: Under the cost-recovery method, companies recognize revenue

Q64: On December 31, 2011 Dean Company changed

Q74: The amount that Nobel should record as

Q76: Qualified pension plans permit deductibility of the

Q76: Heinz Company began operations on January 1,

Q95: Which of the following best represents the