Use the following information for questions.

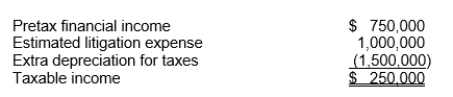

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-The net deferred tax liability to be recognized is

Definitions:

5-Membered Ring

A cyclic structure in organic chemistry consisting of five atoms, which can be of the same or different elements.

Amino Acid

An organic molecule that serves as the building block of proteins, containing both an amino group and a carboxyl group.

α-Carbon

Refers to the first carbon atom that attaches to a functional group in an organic molecule, playing a crucial role in the structure and reactivity of molecules.

Biological pH

The measure of acidity or alkalinity within living organisms or biological systems, crucial for maintaining homeostasis and enzymatic activities.

Q23: Haystack, Inc.manufactures machinery used in the mining

Q27: What is the rate of return on

Q44: On January 1, 2011 Reese Company granted

Q46: The book value per ordinary share at

Q46: Permanent differences do not give rise to

Q48: The total effect of the errors on

Q53: At December 31, 2011, the book value

Q62: On January 1, 2009, Neal Corporation acquired

Q75: In determining net cash flow from operating

Q75: Assume that Leicester Ltd.leased equipment that was