Use the following information for questions.

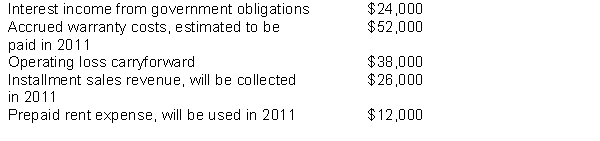

At the beginning of 2010; Elephant, Inc.had a deferred tax asset of $4,000 and a deferred tax liability of $6,000.Pre-tax accounting income for 2010 was $300,000 and the enacted tax rate is 40%.The following items are included in Elephant's pre-tax income:

-Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2010?

Definitions:

Avoiding

A conflict management strategy where individuals or parties choose to sidestep or withdraw from a conflict situation.

Interpersonal Conflict Management

The process of identifying and handling conflicts in a constructive manner between individuals.

Pooled Interdependence

A work scenario where different departments or groups contribute independently to a common outcome.

Reciprocal Interdependence

A mutual reliance among members of a group, organization, or system where the actions of one entity directly affect the outcomes of others.

Q4: The balance of the defined benefit obligation

Q14: With respect to this capitalized lease, for

Q42: Leasing equipment reduces the risk of obsolescence

Q43: Link's income statement for the year ended

Q50: Cash equivalents include<br>A)treasury bills, equity investments and

Q54: Cash equivalents are<br>A)treasury bills, commercial paper, and

Q56: Which of the following best describes current

Q58: Assume that the 2010 errors were not

Q78: Link Sink Manufacturing has a deferred tax

Q84: In computing the annual lease payments, the