Use the following information for questions.

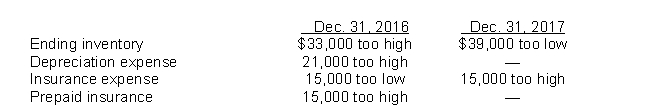

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's retained earnings at December 31, 2017 is that the balance is understated by

Definitions:

Indirect Approach

A communication technique where the main point or message is presented later in the message after introductory remarks, often used to prepare the reader for the information or to soften the impact.

Bad-News Message

Communication that conveys disappointing, negative, or unfavorable information to the recipient.

Defamation

The act of damaging someone's reputation through false or malicious statements.

Accusations

Charges or claims that someone has done something illegal or wrong.

Q17: On December 31, 2010, Gonzalez Company granted

Q18: Melon Corp.is engaged in manufacturing operations in

Q29: A company should allocate the proceeds from

Q31: Fleming Company has the following cumulative taxable

Q39: When is a lease recognized as an

Q45: Which of the following transactions would NOT

Q51: When the equipment was sold, the Buildings

Q63: On May 1, 2017, Durban should credit

Q64: Hedge accounting is<br>A)mandatory.<br>B)mandatory if specified criteria are

Q98: An analysis of equity of Hahn Corporation