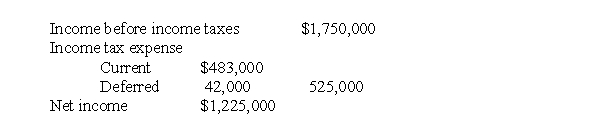

Columbia Corp.'s partial income statement for its first year of operations is as follows:  Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Columbia uses straight-line depreciation for financial reporting purposes and CCA for tax purposes. The depreciation expense for the year was $700,000. Except for depreciation, there were no other differences between accounting income and taxable income. Assuming a 30% tax rate, what amount was claimed for CCA on the corporation's tax return for the year?

Definitions:

Extensors

muscles that increase the angle between components of a limb, working to extend or straighten out the limb.

Tissue

Groups of similar cells in an organism that work together to perform specific functions.

Pathology Present

The existence of disease or disease processes as identified by studying bodily tissues and fluids.

Muscular

Relating to or affecting the muscles of the body.

Q3: G lost his small manufacturing facility to

Q8: Market discount only occurs when there is

Q15: Like-kind exchange treatment only applies if no

Q29: One of the benefits of the statement

Q29: The alternative minimum tax applies to which

Q34: In order for a retirement plan to

Q48: At the end of 2017, its first

Q49: The economic entity assumption<br>A)is inapplicable to unincorporated

Q55: On a sale of real property, if

Q66: Revenue from selling products is generally recognized<br>A)at