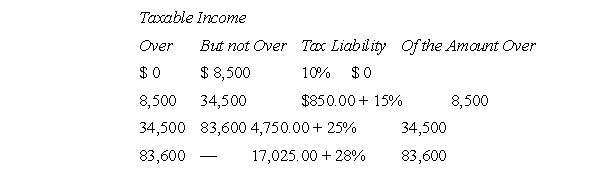

H is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $70,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $30,000.The 2011 tax schedules for single taxpayers are as follows:  H's federal gross income tax for 2011 is

H's federal gross income tax for 2011 is

Definitions:

Wind Directions

The direction from which the wind originates, used to describe weather patterns and conditions.

Cease

To bring or come to an end; a halt or stop.

Estuary

Portion of the ocean located where a river enters and fresh water mixes with salt water.

Q2: Fair value (of an asset)is<br>A)an entry price.<br>B)an

Q5: In a principles-based standard-setting system (such as

Q7: Ms.G obtained a 40 percent interest in

Q19: M works for MND Corporation, whose headquarters

Q37: In which case are expenses not deductible

Q42: Assuming that the errors made in 2017

Q49: Columbia Corp.'s partial income statement for its

Q52: Cash basis taxpayers are not allowed a

Q53: A group of doctors own Glenbrook Manor

Q68: The following information is available for Royal