Figure 12-3

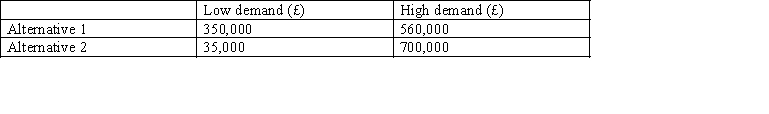

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:

-Refer to Figure 12-3. Using the data above relating to the Lee Company, which alternative should be selected using the regret criterion?

Definitions:

Marginal Cost

Marginal cost is the change in total cost that arises when the quantity produced changes by one unit. It's pivotal in decision-making processes regarding increasing or decreasing production.

Marginal Revenue

The extra financial gain from selling an additional unit of a product or service.

Profit

The profit earned when the revenue generated from a business operation surpasses all its associated expenses, costs, and taxes required for the operation.

Competitive Market

A market structure characterized by a large number of buyers and sellers, where no single participant can significantly influence price or supply.

Q6: CA suspects that a Mega Corp., a

Q15: The strongest form of audit evidence:<br>A)Auditor's direct

Q22: Selling and administrative costs are classified as<br>A)

Q37: When an adverse opinion is given all

Q37: The budget that is a comprehensive financial

Q44: The compliance assertion is not normally listed

Q60: Mills Company uses standard costing for direct

Q61: Refer to Figure 16-2. What is the

Q64: Maxim, Inc., is considering two mutually exclusive

Q78: Arlo Company uses an annual cost formula